Crescat’s Live Market Call – April 19, 2024 Commentary

April 19, 2024 - Discusses various topics including valuation of tech stocks, correlation of Bitcoin with NASDAQ, the role of gold as a hedge, concerns over rising Treasury yields, and potential impacts of government fiscal policies on commodity markets and mining prospects. Then Quinton Hennigh takes over to cover recent news from the exploration mining field. Learn More »

Crescat’s Live Market Call – April 12, 2024 Commentary

April 12, 2024 - Provides macro and geologic updates on mining research, emphasizing timely news across holdings and advocating for activist investments to help create metal deposits worldwide. The call discusses persistent inflation trends, contrasts them with Fed expectations, analyzes stock positions, and shares insights on gold market performance. Learn More »

Crescat’s Live Market Call – April 5, 2024 Commentary

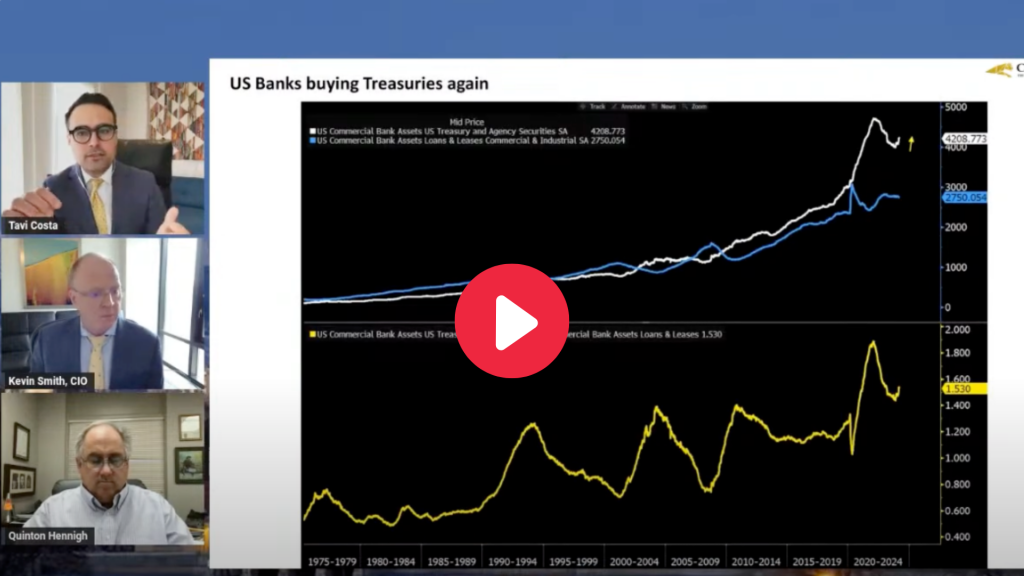

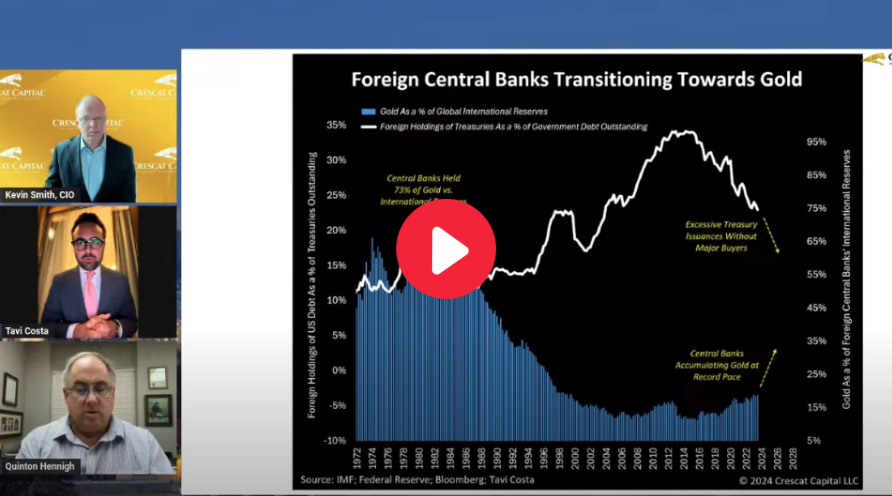

April 5, 2024 - The team highlights the current opportunity within gold, specifically exploration miners, as they make the case for why the "Fed is trapped". As inflation is rising foreign central banks continue to build their positioning in gold. Dr. Hennigh covers the current commodities market and provides insight on the latest Crescat holdings news. Learn More »

Crescat’s Live Market Call – March 28, 2024 Commentary

March 28, 2024 - Crescat Live Market Call provides updates on macroeconomic trends and geologic developments in the mining industry. The call highlights opportunities in undervalued mining stocks and emphasizes the importance of copper and zinc exploration. Crescat plans to capitalize on promising geological discoveries, aiming to expand its resource base and navigate the evolving market landscape. Learn More »

Crescat’s Live Market Call – March 22, 2024 Commentary

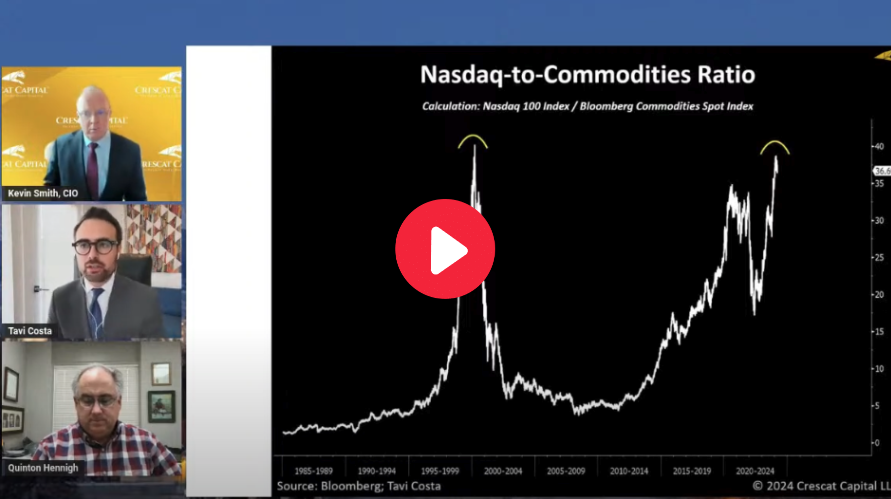

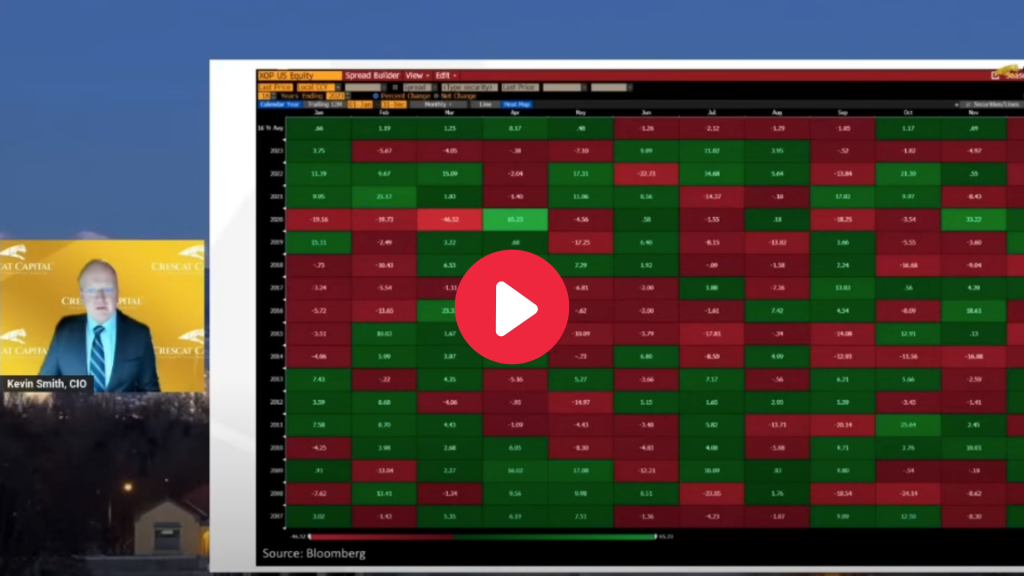

March 22, 2024 - Crescat's Live Market Call delves into macro and activist mining research, emphasizing timely updates on geological progress and advocating for mining investments. They highlight concerns about overvaluation in US equity markets, particularly in large-cap growth and tech stocks, and discuss the increasing significance of silver investments globally, citing industrial demand and historical mining opportunities. Learn More »

Crescat’s Live Market Call – March 15, 2024 Commentary

March 15, 2024 - Highlights concerns about market frothiness, particularly in technology and consumer discretionary sectors, and discusses gold and silver market trends, inflationary concerns, and the role of central banks. The call also touches on specific mining companies' activities and exploration updates, emphasizing the importance of management teams and potential investment opportunities for contrarian investors. Learn More »