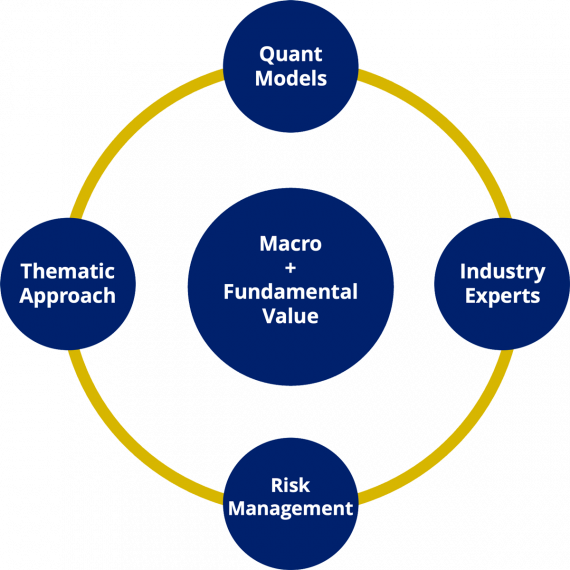

A robust and repeatable investment process is critical to delivering strong absolute and risk-adjusted returns over the long term. Crescat’s investment process has persistently revolved around three key factors: global macro themes, value-driven models, and prudent risk management.

Global Macro Themes

Our goal in focusing on global macro themes is to provide investors and asset allocators with a unique source of high expected alpha with low correlation to common benchmarks and other managers over time. We believe that getting big-picture investment themes right is key to growing and protecting capital. By focusing on big macro investing themes, Crescat has been well-positioned ahead of and capitalized on many major market events.

We provide transparency into our themes and the research behind them in our forward-looking research letters. We also publish research briefs on social media, foremost on Twitter, highlighting timely macro thinking and investment ideas. We strongly encourage you to follow Kevin Smith, CIO and Tavi Costa, Macro Strategiest, on Twitter to see Crescat’s macro thought leadership in action. At Crescat, our model-driven macro themes shape the portfolios in all our strategies. Each individual security in our portfolios is an expression of a bigger picture trend or imbalance that guides our overall long and short exposures in our hedge funds. Crescat’s unique themes drive portfolio construction, diversification, risk modeling, and profit attribution to differentiate Crescat within the investment management industry.

Value-Driven Models

Crescat deploys a variety of proprietary quantitative equity and macro models. The models help both with the development of our macroeconomic themes as well as individual security selection.

Our flagship equity quant model systematically scores, ranks, and values 2000 of the most liquid global stocks combining more than six fundamental factor categories and 50 underlying fundamental metrics.

-

- Quality

- Value

- Growth

- Earnings and Sales Dynamics

- Capital Allocation

- Balance Sheet

Crescat’s models have been an essential driver of our long-term track record in all strategies since their respective inceptions.

Prudent Risk Management

As value investors, we are comfortable accepting an appropriate amount of risk in order to realize the strong returns we see as possible from our macro themes and valuation models over complete business cycles.

-

- Our investment principles and models give us the confidence that the intrinsic value of our portfolios is substantially greater than the current market price. As such, we believe pullbacks in Crescat’s strategies offer great opportunities for both new and existing investors to deploy capital.

- Crescat believes in portfolio diversification across securities and among independent, non-correlated macroeconomic themes which can be accomplished by various combinations across the firm’s investment strategies to tailor to individual client needs, objectives, and risk tolerance.

- Individual position sizing is a function of investment team conviction, security-specific volatility, correlation with other securities in the existing portfolio, and contribution to theme-level and overall portfolio risk.

- We view market volatility as our friend to help us initiate long positions cheaply and short positions at high valuations, which can ultimately deliver strong appreciation.

- Clients desiring less volatility can make a lesser relative allocation to Crescat’s strategies and can combine Crescat’s strategies with cash and short-term fixed income investments to reduce risk.

Clients need to be able to embrace the same mindset that we employ in Crescat’s strategies are not a permanent loss of capital or our strategies will not likely be suitable for them.

Primary Values & Supporting Methods

- Development and expression of tactical macroeconomic themes.

- Proprietary valuation-based research.

- Quant models

- AI Quantamental Equity

- Macro

- Precious Metals

- Energy

- Hiring of industry professionals whom we consider to be experts in their field.

- Risk management that embraces volatility to realize intrinsic value.